- Loanitt Blog

- January 7, 2022

How much money can I save by switching my mortgage?

The Central Bank of Ireland has reported that over 60% of switched mortgages are €10,000+ cheaper over the remaining term of the loan.

The latest Central Bank of Ireland report on mortgage switching recorded that 61pc of eligible switchers could save over €10,000. Some 13pc stand to gain over €30,000.

Homeowners are paying an average of €4,000 extra per year by not switching lender.

So why do people not switch in Ireland? The answer is simple, they don’t realise how much money they could save, or they believe the process is too long and complicated. But with Loanitt, we do all the work so you don’t have to.

Let’s look at some numbers;

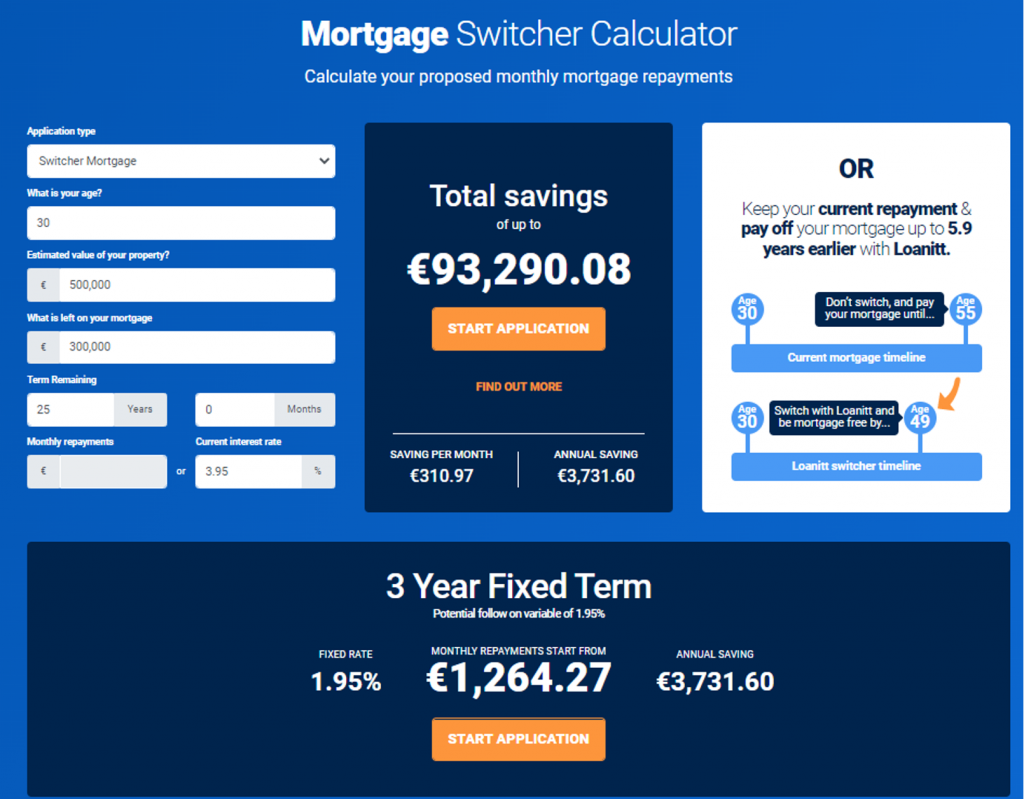

Example 1:

Let’s say your house is valued at €500,000 and you are looking to switch the remaining mortgage of €300,000, with 25 years remaining and a variable rate of 3.95%.

You could switch to a 1.95% fixed rate over three or five years which works out at a repayment of €1,264.27 a month. So, if you’re currently on a standard variable rate of 3.95% that works out at a saving of €310.97 a month or a saving of just over €18,658 over the five years.

Or you could reduce your term by keeping your payments and paying off your mortgage 6 years earlier.

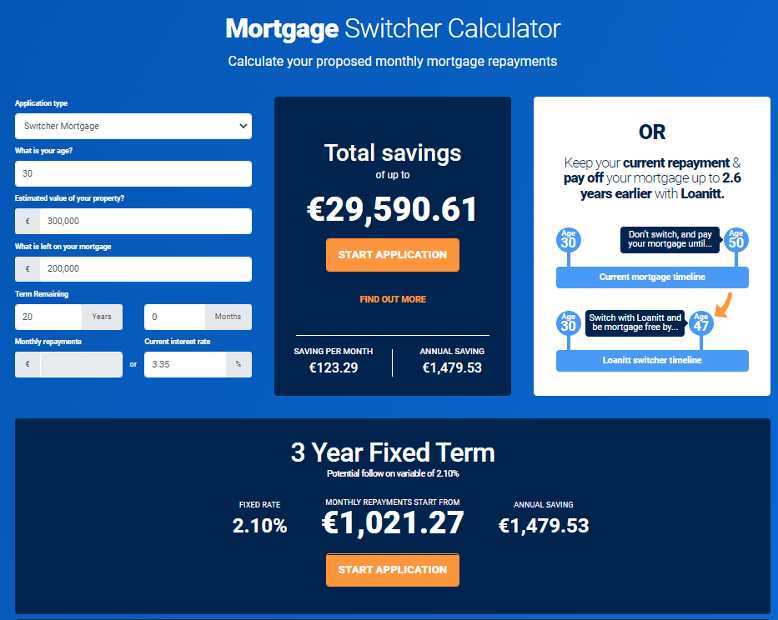

Example 2:

Let’s say your house is valued at €300,000 and you are looking to switch the remaining mortgage of €200,000, with 20 years remaining and a variable rate of 3.35%.

You could switch to a 2.10% fixed rate over three, four or five years which works out at a repayment of €1,021.27 a month. So, if you’re currently on a standard variable rate of 3.35% that works out at a saving of €123.29 a month or a saving of just over €7,397.65 over the five years.

Or you could reduce your term by keeping your payments and paying off your mortgage 2.5 years earlier.

There are some costs to switching

There will be some costs to switching your mortgage. The fees include a solicitor’s fee as well as a property valuation fee.

Most lenders are offering cashback of up to 3% of your mortgage to help towards the costs of switching which in most cases more than offset these costs.

It is worth remembering that regardless of whether your new lender is offering you cashback, in most cases the savings are good you’d be crazy not to switch.